Tuesday June 20: Five things the markets are talking about

Despite the lack of economic fundamentals to use as a direction, the ‘mighty’ U.S. dollar remains better bid as investors look ahead to another week of public appearances by Fed officials.

For most of Q2, the dollar has been underperforming on market doubts that the Fed would be hiking U.S rates again this year. Despite weaker U.S fundamentals of late, investors should expect Fed talk to continue to support the greenback in the short-term.

Yesterday, New York Fed President Dudley said that he was “very confident” that there is “quite a long ways to go” in the economic expansion. Last night, Chicago Fed President Evans said:

The current environment supports very gradual rate hikes.

Current Fed-fund futures are showing that the odds for another rate increase from the Fed this year stands at around +47%, the probability was around +41% on Friday.

Boston’s Fed Eric Rosengren and Fed Vice-Chair Stanley Fischer speak today, while Fed governor Jerome Powell and St. Louis Fed chief James Bullard are due later in the week.

1. Stocks print record highs

Stateside yesterday, the equity markets regained steam with the tech sector leading the way. Both the Dow and S&P reached new all-time highs with closes at 21,528 and 2,453 respectively.

In Japan, the Nikkei (+0.8%) and broader Topix (+0.7%) both jumped to a two-year high overnight, powered by the record highs on Wall Street, a weaker yen and hopes for the global economy.

Down-under, Australia’s S&P/ASX 200 Index slipped -0.8% – the country’s largest banks weighing on the index following yesterday’s ratings downgrades from Moody’s Investors Service.

In Hong Kong, the Hang Seng Index fell -0.3% and the Shanghai Composite Index dropped -0.1% as excitement over the city’s plans for a new listing board for “new economy” companies waned.

Note: MSCI will announce today whether it will approve Chinese-listed stocks in its global benchmarks. The +$6.8T ‘onshore’ market is the world’s second largest and accounts for +9% of global stock value – the decision is expected after the bell.

In Europe, indices are trading largely higher across the board seeing follow through from the strong showing in the U.S. yesterday. The FTSE futures got a boost this morning following BoE Carney comments (see below).

U.S stocks are set to open in the ‘red’ (+0.1%).

Indices: Stoxx 600 +0.2% at 393, FTSE +0.3% at 7545, DAX +0.4% at 12934, CAC 40 +0.5% at 5334, IBEX 35 +0.1% at 10855, FTSE MIB +0.3% at 21070, SMI +0.4% at 9063, S&P 500 Futures +0.1%

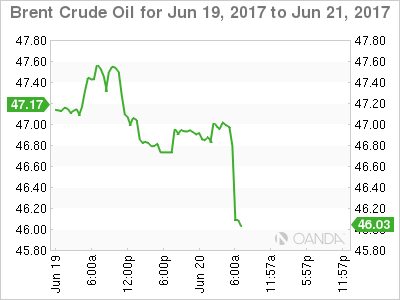

2. Oil prices near seven-month lows on global oversupply

Oil prices trade atop of their seven month lows, weighed down by an expansion in U.S drilling that has helped to maintain high global supplies despite OPEC’s initiative to tighten the market by cutting production.

Also, signs of faltering demand are also weakening global sentiment.

Brent crude futures are up +15c at +$47.06 per barrel, while U.S West Texas Intermediate (WTI) crude futures are up +16c at +$44.35 per barrel.

Note: Prices for both benchmarks are down -14% since late May, when OPEC formally extended its pledge to cut output by -1.8m bpd for an extra nine months.

Data out Friday afternoon in the U.S. showed another week of rising active U.S. oil-drilling rigs, bringing the count to +747, the most since April 2015.

Even at such low price levels, questions on the U.S. ‘shale’s’ ability to keep profitable are being asked.

Data also shows that supplies from OPEC also jumped last month, driven by recovering output from Libya and Nigeria, which were exempt from cuts due to unrest that had hindered their output.

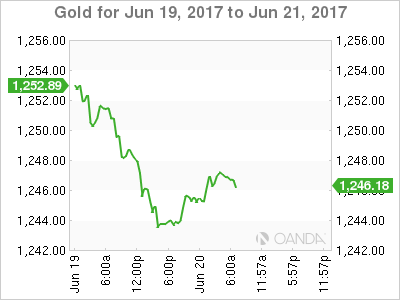

Ahead of the U.S. open, gold has inched higher (up +0.3% at +$1,246.82 per ounce), supported by global political uncertainties – risk aversion due to Brexit, concerns over U.S President Trump’s ability to carry out financial reforms, election results in Europe and Middle East turmoil have provided some support for the precious metal.

3. Global yields range trade

Government bond yields, especially in Germany and the U.S., have been range-bound ever since last November and there is nothing to suggest that this trend will change anytime soon.

With the Fed and the ECB having already made key decisions, they now appear to be waiting for inflation pressures before becoming more ‘hawkish.’

U.S. 10-Year notes have traded between +2.12% and +2.60% since Trump’s U.S Presidential win, while German 10-Year yields have traded between +0.15% and +0.5% and U.K. gilts have fluctuated between +1% and +1.5% over the period.

Overnight, the yield on 10-year Treasuries has fallen -1 bps to +2.18%, after rising +4 bps yesterday, while benchmark yields in the U.K fell -3 bps to +1.01% on BoE comments (see below).

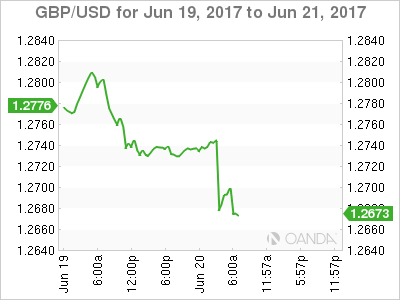

4. The pound walloped on Carney talk

Ahead of the U.S. open, sterling (£1.2683) is under pressure after Bank of England Governor Carney suggested weak wage growth meant it was too early to raise interest rates.

During a rescheduled Mansion House speech this morning, Carney said “anaemic” wage growth raised questions about the strength of domestic inflationary pressures, while he was unsure how the economy would respond to talks between the U.K. and the E.U on Brexit terms.

The comments come after last week’s BoE minutes unexpectedly showed three out of eight policymakers voted to raise rates due to high inflation.

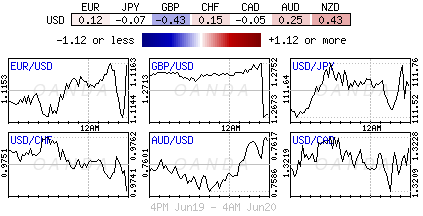

Elsewhere, overall price action sees the USD steady across the board, aided by recent ‘hawkish’ Fed commentary and rising U.S bond yields. USD/JPY (¥111.54) trades atop of its three-week high, while the EUR (€1.1157) is little changed near yesterday’s outright lows.

5. RBA meeting minutes reinforce neutral stance

Minutes of the RBA’s June 6 policy meeting, which resulted in interest rates being left unchanged at a record low +1.5%, indicated the board expected data to show the domestic economy to slow in Q1.

The economy grew by just +1.7% y/y in Q1, with some of the weakness attributable to a cyclone in Queensland, which inhibited coal exports.

The RBA noted improvement in global economic conditions and sustained property construction investment in China. Their main focus in coming months will remain trends in employment and also the housing market.

Note: Recent data on both fronts showed unemployment falling to a four-year low, while soaring house price growth has showed signs of cooling in some markets.

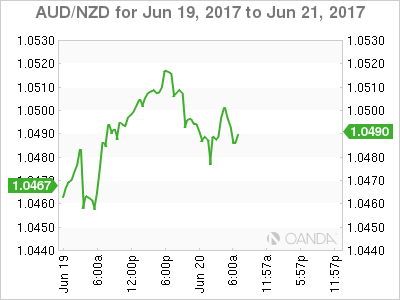

The minutes were consistent with upbeat comments from RBA’s Governor Lowe on Monday, but did not have much effect on AUD (A$0.7625) because the RBA has been optimistic for some time.